Tyme Bank Loan Requirements – Discover the eligibility criteria, required documents, how to apply for a Tyme Bank loan and tips to increase your approval chances.

Tyme Bank Loan Requirements | Eligibility, Documents & Application Guide

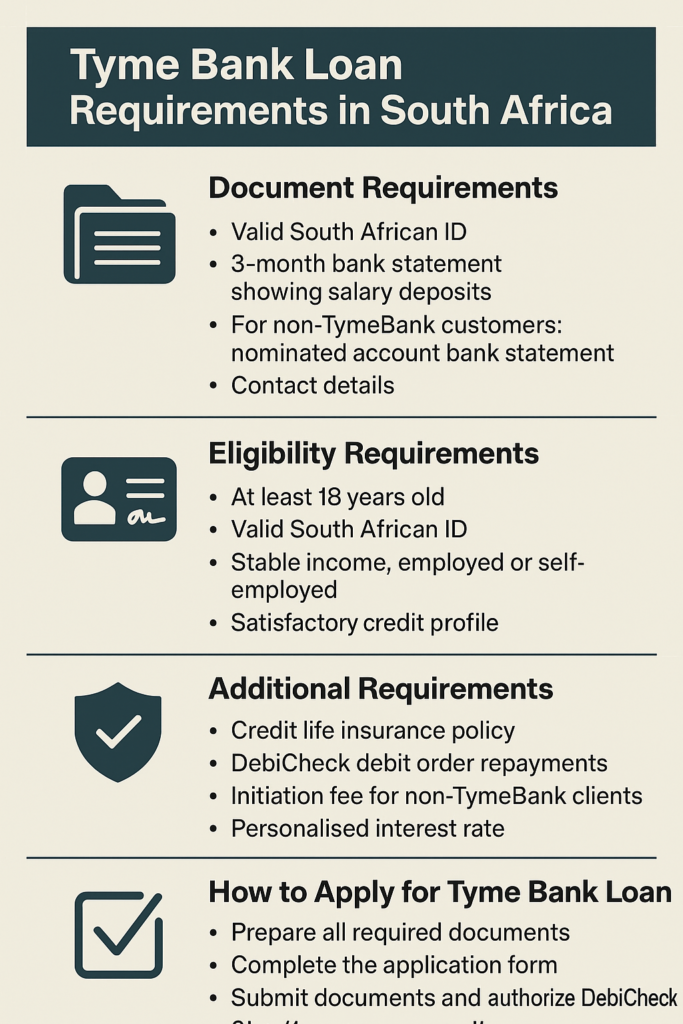

Tyme Bank Loan Requirements in South Africa

Introduction

TymeBank offers personal loans to South African residents — a popular option for those needing quick access to funds for expenses like home improvements, education, medical bills, or managing cashflow. Many people search for “Tyme Bank Loan Requirements” to determine whether they qualify and what they need to apply. This article outlines exactly what you need to know — who can apply, what documentation is required, the process, costs, and contact details.

All Tyme Bank Loan Requirements in South Africa

When applying for a loan with TymeBank (in partnership with TFG Money), you must meet a combination of document, eligibility, and compliance requirements. (tymebank.co.za)

Document Requirements

To apply for a TymeBank personal loan, you need:

- A valid South African ID (smart ID or ID document). (tymebank.co.za)

- A 3-month bank statement showing your most recent salary (or income) deposits. (tymebank.co.za)

- For non-TymeBank customers: bank statement of nominated account (for disbursement) plus contact details (mobile number and email). (zar-loans.co.za)

Eligibility Requirements

Applicants must:

- Be at least 18 years old. (tymebank.co.za)

- Have a valid South African ID. (tymebank.co.za)

- Have a stable income: either employed or self-employed, with regular deposits reflected in the 3-month statement. (zar-loans.co.za)

- Have a satisfactory credit profile/score; they assess affordability, banking and credit history. (tymebank.co.za)

- Not be under debt review. If you are under debt review, you must have fully paid up and obtained a clearance certificate before applying. (tymebank.co.za)

Also: You do not need to already be a TymeBank customer — non-customers can still apply. (tymebank.co.za)

Additional Requirements

Fees / Credit Life Insurance

- A credit-life insurance policy is compulsory for all loan terms. It covers death, permanent or temporary disability, unemployment or inability to earn an income. (tymebank.co.za)

- If not already a TymeBank customer, you may need to contact TymeBank to pay the initiation fee upfront. Proof of Payment (POP) must be emailed to loandoc@tymebank.co.za. (tymebank.co.za)

Repayment mechanism

- Monthly repayments are deducted automatically via a “DebiCheck” debit order from the account you provide. (tymebank.co.za)

- Early settlement is allowed — you may pay off the loan at any time. (tymebank.co.za)

Credit assessment

- Your loan offer depends on affordability, credit profile, income vs expenses. (tymebank.co.za)

How to Apply for Tyme Bank Loan in South Africa

Follow these steps to apply for a TymeBank personal loan: (tymebank.co.za)

- Prepare all required documents — Ensure you have a valid SA ID and a 3-month bank statement showing recent salary/income deposits.

- Check eligibility — Confirm you meet age, income, and credit score requirements. This step often happens automatically online.

- Complete the application form —

- If you are a TymeBank customer: open the TymeBank SmartApp, navigate to “Personal Loan,” and click “Apply Now.” (tymebank.co.za)

- If you are not a TymeBank customer: go to TymeBank’s Personal Loans web portal (partnered with TFG Money) and start application online. (tfgmoney.loan.tymebank.co.za)

- Submit your documents — Upload or email the 3-month bank statement (and other required info) as part of the application. TymeBank may ask you to email to loandoc@tymebank.co.za. (tymebank.co.za)

- Sign the contract online — No physical paperwork needed. Once you sign, TymeBank emails the loan agreement and other documents. (tymebank.co.za)

- Authorize the DebiCheck debit order — This enables automatic monthly repayments. (tymebank.co.za)

- Receive funds — Once approved and mandate is authorised, funds are disbursed directly into your TymeBank account (if you’re a customer) or your nominated bank account (if you’re not). (tymebank.co.za)

Tyme Bank Loan Fees and Costs

- Credit life insurance premium — part of your monthly instalment; calculated per R100 outstanding loan amount (for death, disability, retrenchment cover) as defined by insurance terms. (mytfginsure.co.za)

- Initiation fee (for non-TymeBank clients) — may apply; you must contact customer care to get payment details, then send proof of payment to loandoc@tymebank.co.za. (tymebank.co.za)

- Interest rate — Personalised based on your credit profile, income and affordability. TymeBank describes their personal loan as among “the cheapest personal loans in SA.” (tymebank.co.za)

If no official fee amount is published (e.g. exact initiation fee amount), users will only know after contacting TymeBank.

Processing Time for Tyme Bank Loan

- Standard time: Once application, document submission, and contract signing are complete — and assuming affordability and credit checks pass — TymeBank disburses money almost instantly. (tymebank.co.za)

- Possible delays: Delays may occur if documents are incomplete, the 3-month statement is unclear, credit profile issues arise, or the DebiCheck mandate is rejected. (tymebank.co.za)

- Fast-track: Because the process is fully digital and no paperwork is required, turnaround is typically very quick once requirements are met. (tymebank.co.za)

Contact Details for TymeBank

- Customer Service / Loan enquiries: 0860 999 119 (tymebank.co.za)

- Email (for loan documents / proof of payment): loandoc@tymebank.co.za (tymebank.co.za)

- Website: https://www.tymebank.co.za — for general banking, or the personal loan portal for loans. (Wikipedia)

- Registered address (main/registered office): 2nd Floor, 30 Jellicoe Avenue, Rosebank, Johannesburg, 2196. (mytfginsure.co.za)

Note: TymeBank operates as a digital-only bank; there are no traditional branches. (Wikipedia)

FAQs — Tyme Bank Loan Requirements

Q: What documents do I need to apply for a TymeBank loan?

A: You need a valid South African ID (smart ID or ID book) and a 3-month bank statement showing your most recent salary or income deposits. (tymebank.co.za)

Q: How long does approval take?

A: If everything is in order and the credit/affordability check passes, funds can be disbursed almost immediately after you sign the contract. (tymebank.co.za)

Q: Can I apply online?

A: Yes. The entire loan application is digital — including document submission and contract signing. (tymebank.co.za)

Q: What happens if I don’t meet the requirements (e.g. bad credit, insufficient income)?

A: Your application will likely be declined. Common reasons include low affordability, poor credit score, or being under debt review. (tymebank.co.za)

Q: Are foreigners eligible for a TymeBank loan?

A: The requirements state you must have a valid South African ID — which implies you must be a South African citizen or permanent resident. (tymebank.co.za)

Q: Is there an age requirement?

A: Yes — you must be at least 18 years old. (tymebank.co.za)

Q: Is a TymeBank account required to get the loan?

A: No — you can apply even if you are not a TymeBank customer. If approved, funds will be deposited into your nominated bank account. (tymebank.co.za)

Conclusion

If you’re a South African over 18 with a valid ID, stable income, and decent credit — a loan from TymeBank (in partnership with TFG Money) could be a quick, simple way to access funds from about R4,000 up to R120,000–R200,000 (depending on credit assessment). You only need a 3-month bank statement and a valid ID, and the application is fully digital with instant payout after approval. Before you apply, ensure your documents are ready, verify your affordability, and be prepared to accept the required credit-life insurance and automatic debit order repayments.

Leave a Reply