Cash Crusaders Loan Information

Cash Crusaders Loan (Secured Pawn Loan Service)

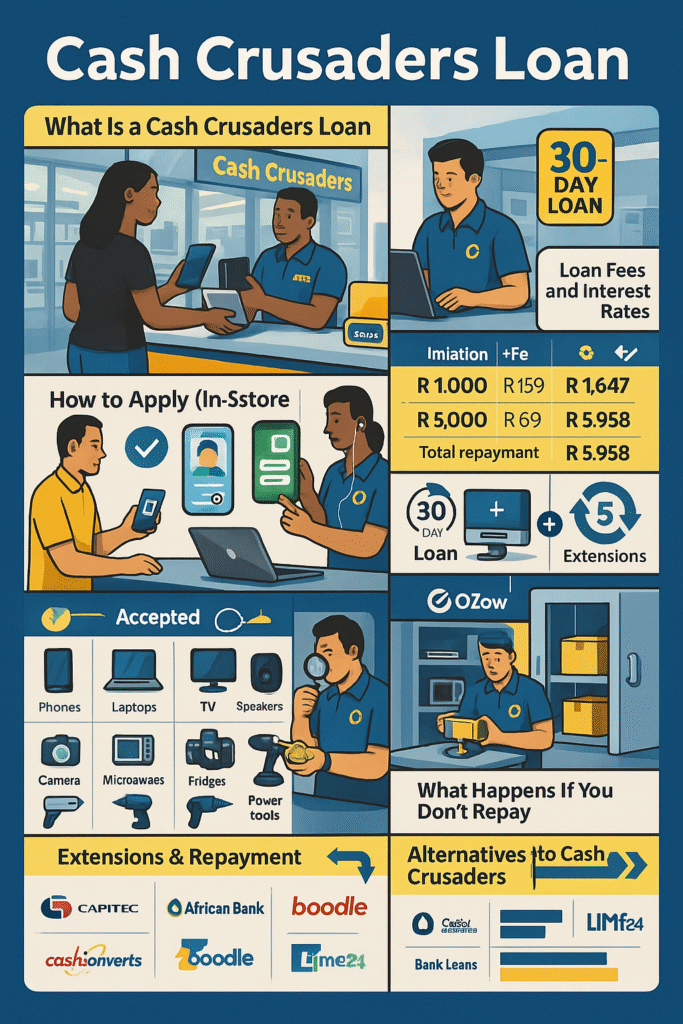

Cash Crusaders Loan is a secured pawn loan service in South Africa that allows you to borrow money quickly by using valuable personal items as collateral.

- Key Features and Process

- You bring an item of value (electronics, jewelry, etc.) to a store for assessment.

- No credit checks, salary slips, or bank statements needed.

- Immediate cash is received upon acceptance of the loan offer.

- The standard loan period is 30 days, extendable up to five times (max six months).

- Fees include an initiation fee, monthly interest, and a service fee.

- Loan amounts can range up to R15,000 or R20,000 for payday loans.

- If you repay on time, you get your item back; if not, Cash Crusaders can sell the pawned item.

How to apply for a Cash Crusaders loan in store or online

List documentation needed to pawn items at Cash Crusaders

- Valid ID: South African ID book, passport, or driver’s license.

- Proof of Residence: Recent utility bill or official document confirming your address.

- Physical Item: The item to be pawned (must be owned by you and in good working order).

- Optional: Ownership documentation or proof of purchase for valuable items (like electronics) can be helpful but is not always mandatory.

- Note: No salary slips, bank statements, or proof of income are required.

How to start a Cash Crusaders loan via WhatsApp step by step

- Find the WhatsApp contact number for your nearest store.

- Send a message expressing your interest.

- Provide your valid ID and proof of residence details.

- Send clear pictures of the item(s) you want to pawn.

- A buyer will assess the item remotely and contact you with a loan offer (usually within 15 minutes).

- Bring the item(s) to the store for physical inspection after agreeing to the offer.

- Receive immediate cash payment.

What items qualify as collateral for Cash Crusaders loans

What items qualify as acceptable collateral in store

- Mobile phones and smartphones

- Computers, laptops, and tablets

- Gaming consoles and equipment

- Home entertainment systems (TVs, speakers, audio players)

- Musical instruments

- Jewelry and watches (including gold and diamonds)

- Large household appliances

- Cameras, photography equipment, and power tools

Which item conditions disqualify items from being accepted

- Non-functioning or broken items (e.g., electronics with cracked screens, appliances that do not work).

- Items with missing essential accessories or parts.

- Stolen or illegally obtained goods.

- Heavily damaged or altered items that significantly reduce resale value.

- Items with counterfeit components or unclear provenance.

How does Cash Crusaders value electronics and appliances

- Assessment Factors: Brand/model popularity, functionality/condition (must be clean and operational), age/technology level, market demand, and completeness (accessories, packaging).

- Process: Staff physically or visually inspect the item, test functionality, and compare current resale market prices.

- Loan Amount: The loan offered is generally a percentage of the item’s estimated retail or resale value.

Can I use jewellery or gold as collateral and how is it priced

- Yes, jewelry and gold are accepted as collateral.

- Pricing: The staff assesses the item’s weight, purity (karat), and overall condition.

- Valuation: Pricing is based on weight and purity, using current market gold and jewelry prices. The loan amount is a percentage of this appraised value.

Compare Cash Crusaders loan fees and interest rates

What are the exact fees for a R1000 30 day loan and one extension

- Initial R1,000 Loan (30 days):

- Initiation fee: R408

- Interest for 30 days: R150

- Service fee: R89

- Total repayment for initial 30 days: R1,647

- One 30-day Extension:

- Extension fees (including service fee and interest) will not exceed R219.

- Total approximate repayment after one extension (60 days): R1,866 (R1,647 + R219).

Calculate total repayment on a R5 000 Cash Crusaders 30 day loan

- Approximate Fees for R5,000 Loan (30 days):

- Initiation fee: Around R639

- Interest and other fees: Approximately R250

- Service fee: About R69

- Total repayment amount: Approximately R5,958

How to calculate total cost of a 30 day payday loan in South Africa

- Calculation Components:

- Principal Amount

- Interest Rate (APR): Prorated for the 30-day period. (e.g., for R1,000 at 18% APR, interest is roughly R15).

- Service/Administration Fees: A fixed service fee (often R69 to R219 per 30 days).

- Initiation/Application Fees: A one-time setup fee paid upfront.

- General Example (R1,000 at 18% APR): R1,000 (Principal) + R15 (Interest) + R69 (Service Fee) = R1,084 Total Repayment.

- Note: Cash Crusaders loan costs are significantly higher than this general example due to their higher initiation and service fees.

Compare interest rates and fees among short term lenders in South Africa

| Lender | Interest Rate (APR) | Key Fees | Notes |

| Cash Crusaders (Pawn) | Very high effective rates (~150-200% APR) | High Initiation (~R408 on R1,000), Service (~R89) | Collateral required, no credit check, very fast cash. |

| Capitec Bank | From 13.5% APR | Application & Admin fees vary | Requires credit/income verification, lower cost, longer terms. |

| African Bank | 20% – 30% APR | Admin fee applies | Personal loans for medium terms, requires credit checking. |

| Boodle Quick Loans | Up to 60% APR | Fees included in repayment | Short-term digital loans (2-6 months), instant approval. |

Repayment options and extension rules for Cash Crusaders loans

What payment methods can I use to repay a pawn loan

- In-store payment: Pay in full or extend at any Cash Crusaders store.

- Online payment via Ozow: Use the secure SMS payment link sent before loan expiry to pay fees or repay in full using internet banking credentials.

- Proxy payment: A friend or family member can pay or extend in-store with a signed proxy form.

How much does each 30 day extension cost at Cash Crusaders

- The cost of each 30-day extension is up to approximately R219.

- This fee includes the service fee (about R69) plus interest and other applicable fees for the extension period.

- The initiation fee is not charged on extensions.

How do Cash Crusaders loan extensions affect total cost

- Each extension adds additional service and interest fees for that 30-day period.

- The total cost increases proportionally with the number of extensions, but the initiation fee is only paid once at the start.

What are the maximum number of extensions and total loan duration

- Maximum Extensions: Up to five additional 30-day terms.

- Maximum Total Duration: Six months (the initial 30-day term plus five 30-day extensions).

How to extend a loan online using the Ozow payment link

- Receive an SMS with the secure Ozow payment link about 3 days before loan expiry.

- Click the link and select your bank.

- Log in using your internet banking credentials.

- Confirm payment of the interest and service fees to extend the loan for another 30 days.

Are there early repayment penalties or refund policies for fees

- Early Repayment Penalties: No, there are no penalties for repaying early.

- Interest: The interest cost is recalculated and reduced if you repay before the 30-day term ends.

- Fees Refund: Initiation fees and service fees already paid are non-refundable.

What are collection and storage policies for collateral items

- Items are stored securely at the store during the loan period.

- A 3-day grace period after expiry may be granted if you are unable to extend or collect on time (communication with the store is advised).

- If the loan is not settled or extended, the item is forfeited and may be sold.

What happens if I miss repayment after all extensions are used

- Forfeiture: The pawned item is automatically forfeited and becomes the property of Cash Crusaders, who may sell it to recover the loan amount.

- No Further Debt: You do not owe any further money to Cash Crusaders.

- No Credit Impact: Your credit record is not affected as these loans do not involve credit checks or reporting.

- No Legal Action: There is no risk of legal action or further penalties.

Alternatives to Cash Crusaders for short term loans in South Africa

Show cheaper short term loan alternatives in South Africa

- African Bank Personal Loans: R2,000 to R250,000 (7 to 72 months, 15% to 24.5% p.a.).

- Capitec Bank Personal Loans: R10,000 to R500,000 (12 to 84 months, from 13.5% p.a.).

- Nedbank Personal Loans: R2,000 to R300,000 (up to 72 months, competitive rates).

- Absa Personal Loans: Up to R350,000 (12 to 84 months, 13.75% to 29.25% p.a.).

- Boodle Quick Loans (Short-Term): Up to R8,000 (2 to 6 months, instant approval, max APR 60%).

Best lenders for bad credit or unemployed borrowers South Africa

- Pawn Loans (Cash Crusaders/Cash Converters): Best for bad credit/unemployed as they require collateral, not a credit check or income proof.

- Lime24 and Letsatsi Finance: Offer small emergency loans (R500-R8,000) with flexible terms, catering to bad credit (high interest).

- Capfin and Mazuma Loans: Provide personal loans with flexible terms even for lower credit scores (R1,000-R50,000).

- InstantFund and Future Finance: Offer payday-style loans without credit checks, relying on income proof and job stability instead.

Pawn shops that allow you to keep driving your car in South Africa

- Lenders: First Advance, pan.org.za, and other specialist car pawn services.

- How it works: Ownership is temporarily transferred, but you keep the car and can drive it. A tracker is typically installed.

- Loan Amount: R10,000 up to 90% of the car’s value (must be fully paid-up).

- Requirements: ID, vehicle registration papers, proof of residence, roadworthy car.

Banks offering quick personal loans with same day payout in South Africa

- African Bank: Instant approval, funds within 48 hours (R2,000 – R350,000).

- RCS: Provisional approval in minutes, funds deposited within 24 hours (R2,000 – R250,000).

- Absa Bank (Instant Cash Loan): Funds available immediately upon approval (R350 – R8,000, due next salary date).

- LendPlus/Finance27: Microloan providers with funds available within minutes or same-day after approval.

Leave a Reply